Personal Loan Apps in India: Top 10 Best Personal Loan Apps in India

Index Of The Blog

Best Personal Loan Apps in India

Getting a personal loan has never been easier with tons and tons of instant personal loan apps in India providing customers with instantly approved loans in a matter of minutes. With the number of available apps in the market, it is difficult to choose the one that fits your needs. Instant loan app provides instant approval of the personal loan and helps customers secure a loan almost instantly.

Using an instant loan app you can apply for a personal loan or check the status of your loan. Most instant loan app will have an easy-to-use interface that will help customers to apply for a loan without much hassle. An instant loan app also cuts down the time required and paperwork involved in a loan approval process. We have compiled a list of the best instant loan apps in India in no particular order that helps in securing personal loan apps in India. This list will help you choose the instant loan app that requires minimum approval time as well as affordable for most.

You should keep in mind that its approval time is different from disbursal time. Your application can be approved within minutes however the funds may take some time to credit in your bank account. As the process is online you are not required to you physically visit all send hard copy documents for the loan approval process. Using the instant loan apps you can upload the necessary documents required for a personal loan. You can also track your due date for EMI so that you do not default or delay the payment of the EMI. You can have full control over your personal loan using instant loan apps. The instant loan apps thus help in applying and managing a personal loan using just a smartphone app. It provides full control to the customer to manage their loans effectively.

Also Know: Best NFC Payment Apps

Best instant personal loan apps in India:

1. MoneyTap

MoneyTap is India’s first app-based credit line. The best part is its no-usage-no-interest feature, which has made taking credit more affordable. Personal Loan Apps in India. Thanks to this feature, you only pay interest on the amount used. It is a personal loan app that provides a line of credit to customers, which works as an instant loan or a credit card.

MoneyTap is essentially a money lending company with flexible interest rates, currently servicing clients in Delhi NCR, Mumbai, Bangalore, Hyderabad, and Chennai as well as 30+ cities in India.

Also Know: Zoom Alternatives

Let’s take a look at a hypothetical example to understand how MoneyTap’s Personal Loan 2.0 works:

Arjun has been approved for a credit line of ₹ 1 Lakh with MoneyTap but he uses only ₹ 50,000 out of it. If he had taken a traditional personal loan he would have been charged interest on the entire ₹ 1 Lakh from day 1. But, with MoneyTap, he will only be charged interest on the amount he uses (₹ 50,000).

With MoneyTap:

Amount to be paid after 1 year, assuming 13% interest rate, loan amount = ₹ 100,000, used only = ₹ 50,000:

50,000 X 13 = 56,500

Arjun will end up paying ₹ 56,500 by end of the year.

With a traditional personal loan:

Amount to be paid after 1 year, assuming 13% interest rate, loan amount = ₹ 100,000: 100,000 X 13 = 113,000

Arjun will end up paying ₹ 113,000 by end of the year.

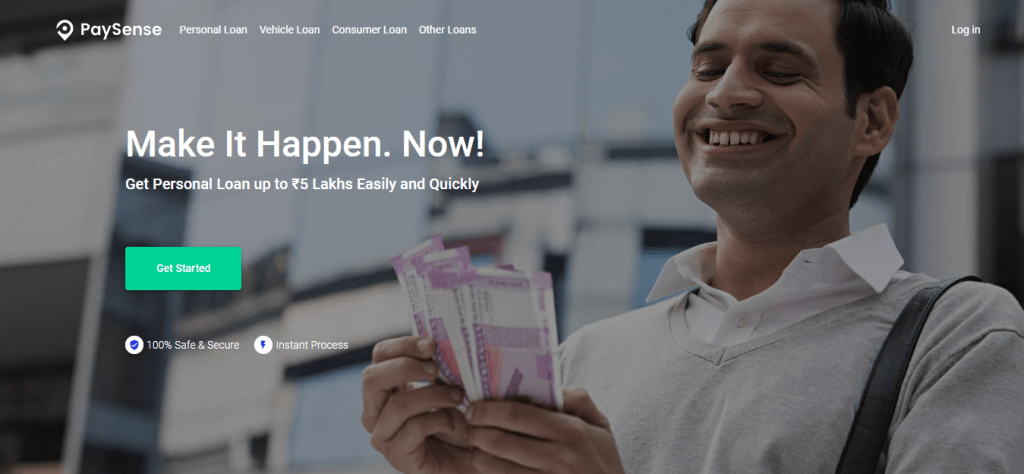

2. PaySense – Personal Loan Apps in India

Founded by SayaliKaranjkar and Prashanth Ranganathan, PaySense is an instant money app that offers instant cash loans online. You can use a phone or laptop to check your loan eligibility, submit your KYC details, and apply for a loan, receiving approval within 5 hours.

Also Know: Best Apple Watch Apps

The company provides Personal Loan apps in India of up to ₹ 5 Lakh and you can use anywhere from ₹ 5,000 up to your entire approved limit at one time. PaySense also offers an EMI calculator through which you can check how much you will be paying every month.

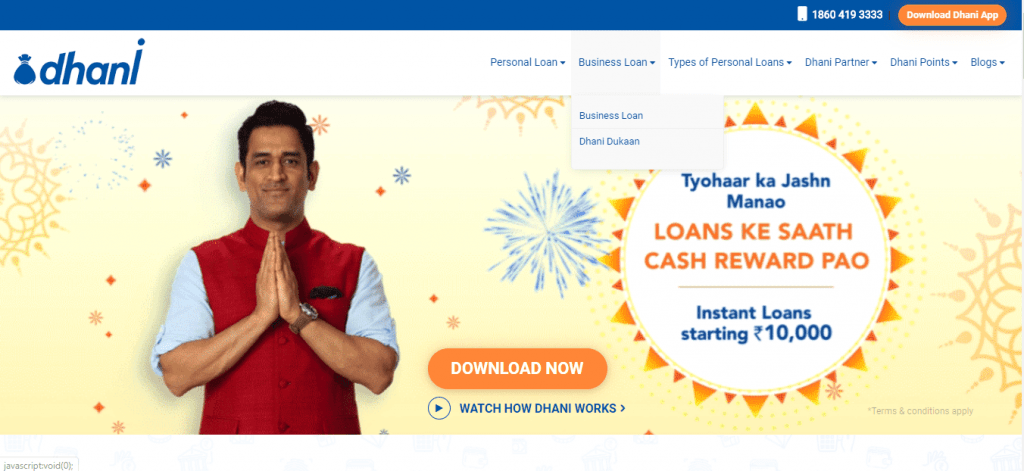

3. Dhani – Personal Loan Apps in India

Dhani popularly marketed as a Personal Loan Apps in India instantly disburses the loan amount to your bank account. You can apply for a personal loan anytime, anywhere. You can get a loan of up to ₹ 15 Lakh instantly at an interest rate starting at 12%.

Also Know: Best Trading App In India

Everyone can download the Dhani loan app for free, enter your Adhaar card number, your loan amount, and get the loan amount in your account instantly.

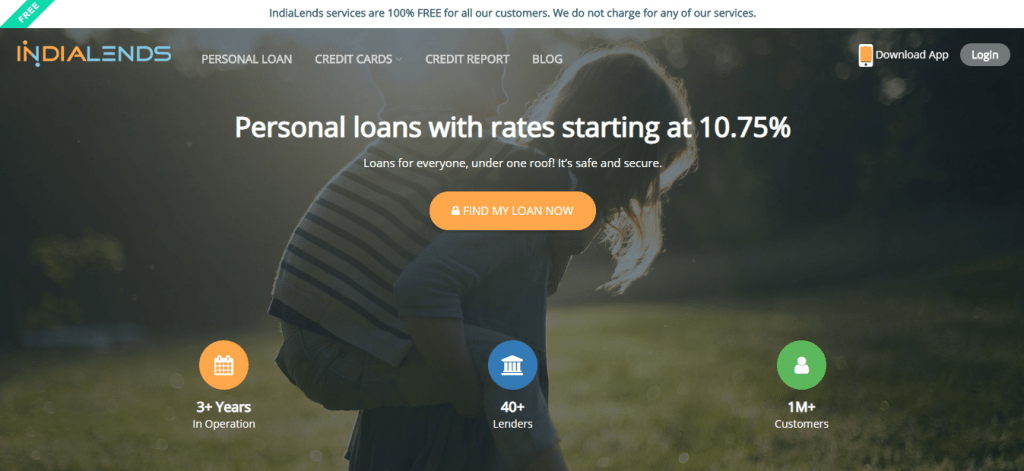

4. IndiaLends

IndiaLends is one of the cash loan apps in India for instant personal loans, credit cards, and free credit reports.IndiaLends offers instant personal loans online with the best interest rate and disburses the loan within 48-hours.

Also Know: Best NFC Payment Apps

IndiaLends’ instant loan app in India extensively makes use of data and technology to improve workflows and risk assessments so that the loan disbursal process is efficient, shorter, and easier.

5. KreditBee – Personal Loan Apps in India

KreditBee is an instant personal loan app for young professionals. You can get a loan of up to ₹ 1 Lakh. The loan process is 100% online. The disbursement is done within 15 mins, and the amount is directly credited to your bank account.

6. NIRA

NIRA is a FinTech company that offers a line of credit to salaried professionals in India. The personal loan apps offered to you are in the form of a line of credit, which has a credit limit range starting from ₹ 3,000 to ₹ 1 Lakh.

The loan tenure ranges from 3 months to 1 year. You can withdraw a minimum of ₹ 5,000 each time. The interest applied to the loan amount depends on how much you borrow and when you repay the borrowed amount.

7. CASHe

CASHe is an app-based digital lending platform that provides short-term personal loans for various financial needs, but only to salaried individuals. You need to provide documents such as salary slips, bank statements, address proof, and a PAN card, which can all be uploaded through the cash loan app while applying for a loan.

Also Know: Adsense Alternatives

you can also check loan eligibility and interest rates online, using a quick calculator. The approved loan amount can range from ₹ 5,000 to ₹ 2 Lakh, with tenures ranging from 15 days to 6 months. Repayments can be made through a bank transfer or cheque deposit every month.

8. Capital First Limited – Personal Loan Apps in India

Capital First’s instant loan app in India is a one-stop solution for most of your financing needs. Your online loan application is sanctioned within 2 minutes. The company provides flexible repayment tenure of 1 to 5 years for a loan amount ranging from ₹ 1 Lakh to ₹ 25 Lakh.

If you are an existing customer, you can easily access your loan account details, statement details and raise service requests. You can also check your outstanding balance and your payment dates.

9. Credy Technologies

Credy is one of the quick loan-giving apps in India that provides personal loans on personalized terms. With no hidden costs, no requirement of collateral or a guarantor, fast online processing, and acceptance of a low CIBIL score, Credy is simple, fast, and low-cost.

The company provides loan durations ranging from 3 to 15 months for amounts between ₹ 10,000 to ₹ 1 Lakh. The rates of interest start at 12%, annualized. You can utilize ready-for-quick cash loans, enhance lifestyle, refinance loans and credit card bills, and finance education- either for yourself or your children.

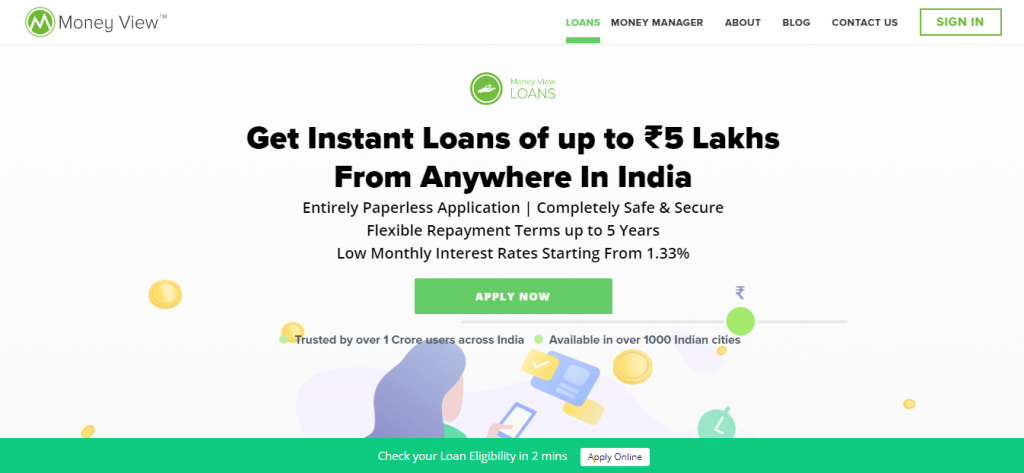

10. Money View – Personal Loan Apps in India

With Money View personal loan app, you can get a personal loan in just 2 hours. Whether you want to remodel your home, buy an expensive ride, or cover your wedding expenses, a personal loan from Money View is completely paperless, fast, easy, and flexible.

Also Know: Manhwa Apps

Money View loan amount ranges from ₹ 10,000 to ₹ 5 Lakh. The repayment period is flexible and ranges from 3 months to 5 years.

Conclusion

Apply for an instant loan through its online loan app in India. Your request is approved and the money is transferred in almost no time.

With so many personal loan apps in the market, the options available for quick cash loans have increased making it easier for you to seek an urgent cash loan quickly. An online search and a quick comparison between the various cash loan apps in India for quick cash loans online bring up a multitude of options ranging from payday loans in India, instant loans in India, to salary advance loans apps in India.

The times really are changing, and Personal Loan Apps in India are ensuring that fast and easy cash loans in India are a reality!

Getting a personal loan was never this easy and instant Personal Loan Apps in India download makes it easier. Get the best loan app in India. Download MoneyTap!

Also Know: Business Communication Platforms